Get tax saving worth RM300000 for childcare expenses for children up to 6 years old. This relief is applicable for Year Assessment 2013 and 2015 only.

Joint And Separate Assessment Acca Global

Estimate your take home pay after income tax in Malaysia with our easy to use and up-to-date 2022 salary calculator.

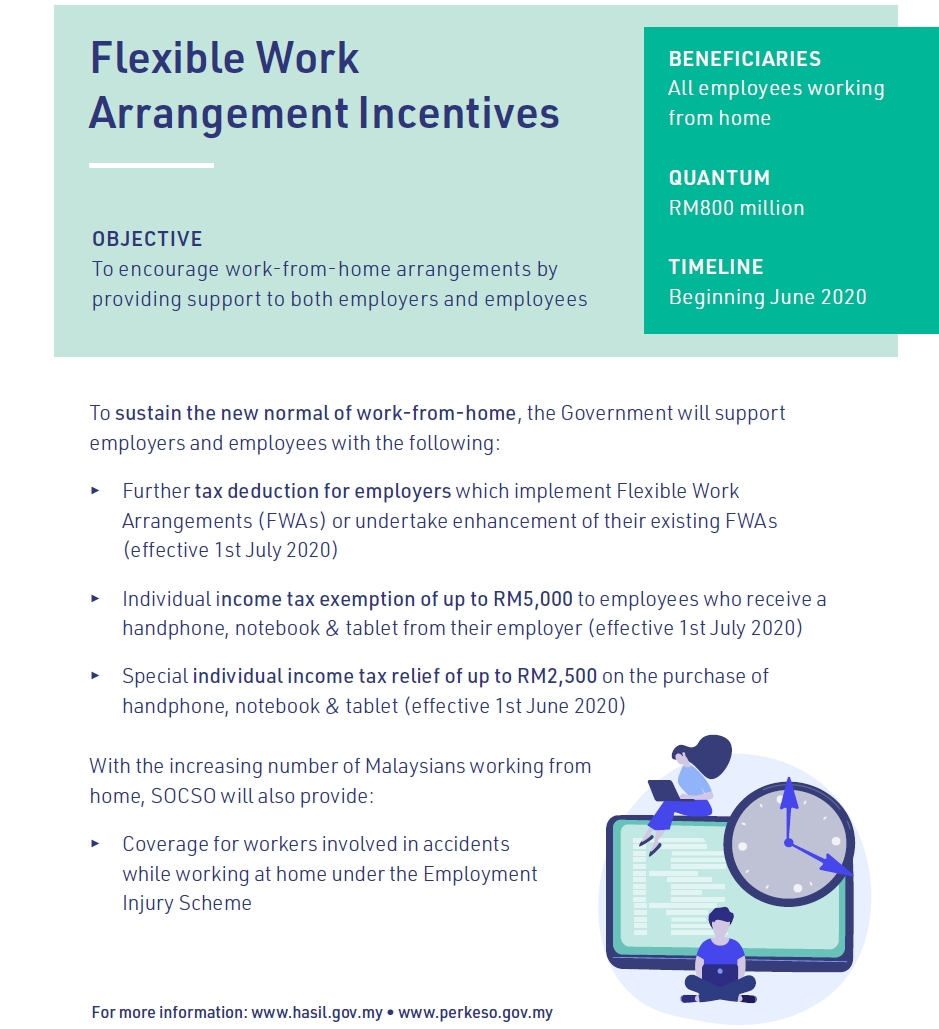

. Please note that is for personal equipment only additional charges. Personal Tax Relief for 2022. This is an initiative devised by the LHDN to help.

Previously the base year was set at 1. Lifestyle purchases for self spouse or child. It is proposed that this tax relief be extended until the year of assessment 2023.

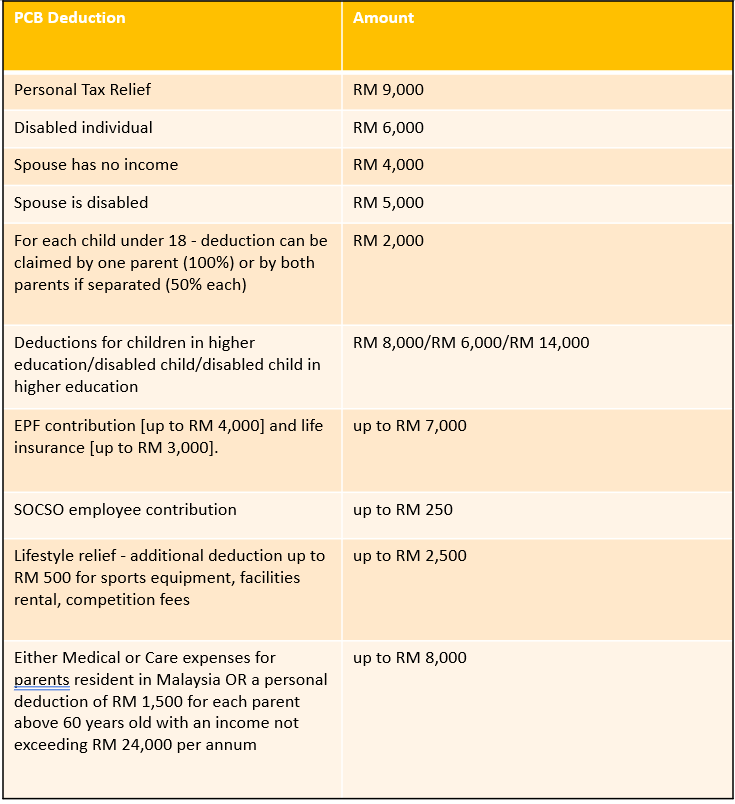

A step-by-step guide with everything you need to know about filing your income tax returns form for Malaysia income tax 2020 year of assessment 2019. Once you have submitted the form to LHDN and a copy to your employer your employer will have to remit the amount deducted to Inland Revenue Board Malaysia IRBM also known as LHDN every month in accordance with Income Tax Deduction and Remuneration Rules 1994. Only applicable to working women with child aged under 2 years.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. As for the shuttlecocks yes you can claim them as tax relief under Lifestyle as they count as sports equipment. As of the assessment year of 2021 in this category you can claim for the purchase of.

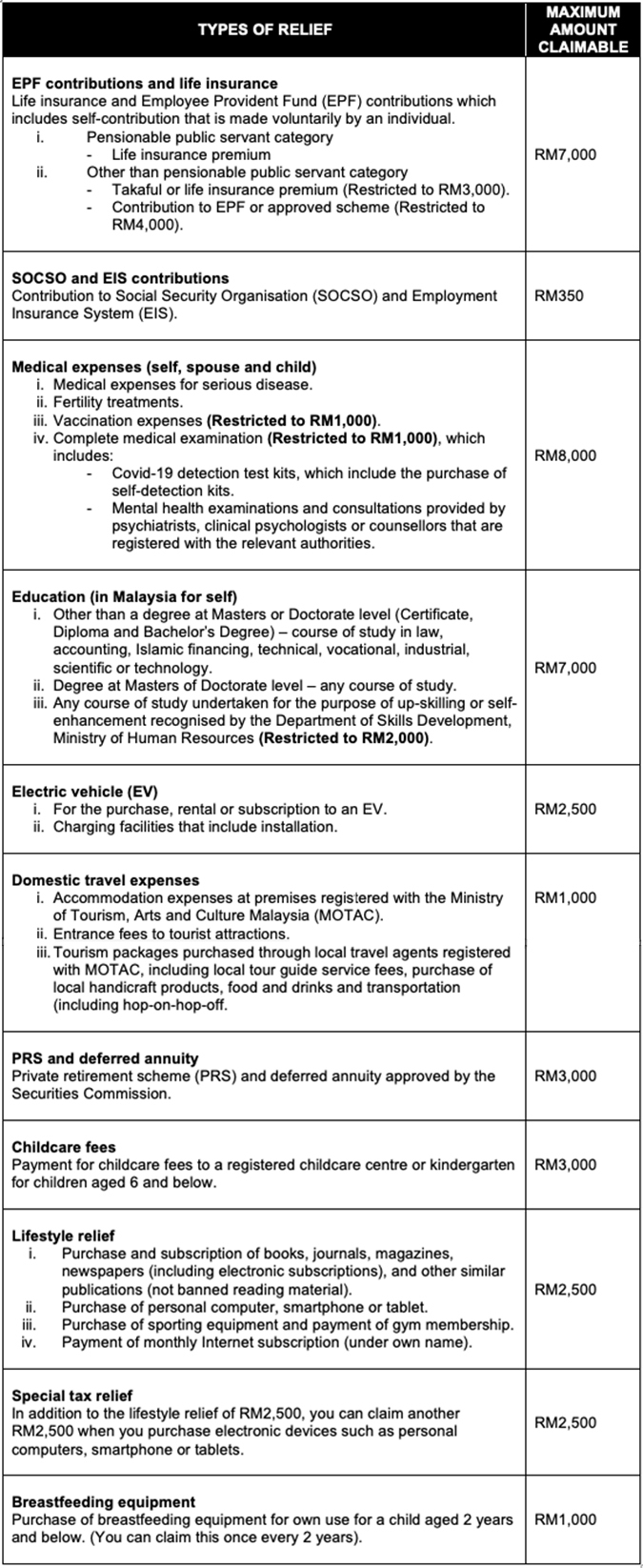

Heres the full list of income tax relief 2021 Malaysia. If planned properly claiming your tax reliefs can help you save a significant amount on your taxes. Claim once every 2 years.

Those earning from 150000 to 250000 will get 1000 in credits and for the first time. Child aged above 18 with following condition. Special express train No.

Public transit is safe and reliable. Under the budget some 870000 families that make up to 150000 would get direct relief of 1500. A tax relief of up to RM2500 is deductible for purchases of lifestyle equipment for personal use by yourself your spouse or children.

No one is homeless. As far as tax credits go which help directly lower the tax itself there is an easily. 45 Bangkok Padang Besar departs from Bangkok Station at 1510 hr and arrives at Padang Besar Malaysia at 0950 hr Thailand time.

During the tabling of Budget 2020 an RPGT amendment was made to provide some relief to property sellers it was announced that for the calculation of property gain tax of units purchased before 2013 the Government will use the market price on 1 st January 2013 as the initial point of valuation. EXTENSION OF TAX RELIEF FOR DOMESTIC TOURISM EXPENDITURE Current Treatment The current provision allows tax relief for individual residents limited to RM1000 for the amount spent or deemed. Serving under indentures or articles to qualify in a trade or profession in Malaysia.

At their core LSAs are employer-funded accounts that employees use to support their individual needs. Earlier this year the Inland Revenue Board of Malaysia LHDN announced that COVID screening and vaccination expenses will be claimable for tax relief in the year of assessment 2021 and 2022. Also known as lifestyle tax relief in Malaysia this is the single persons favourite category under the topic of Personal Tax Reliefs.

Deductions exist to help lower your taxable income with some of the most common ones being the personal relief and the lifestyle relief. There are unlimited tax reliefs for Zakat expenses for Muslims who have to make this compulsory contribution. Which One Is Better.

Domestic travel travelling within Malaysia expenses have RM100000 tax relief. Receiving full time education diploma and degree onward ii Breastfeeding Equipment RM 1000. 603 7803 9892 Fax.

These accounts dont have an official name so you may know them as life accounts lifestyle accounts or life planning accounts and employers and vendors have given them custom names like Choice Account and Benefits Your Way. Best Reit In Malaysia. 603 7803 9807 Email.

Laptops personal computers smartphones or tablets. Supporting expenses tax relief of RM600000 when it comes to the. Years of Assessment 2022 and 2023 5.

To create the list of Americas Best Tax Accounting Firms 2022 the market research company Statista considered survey responses from CPAs enrolled agents tax lawyers accountants and CFOs. Child aged below 18. No one is starving.

Tax Relief for Child i Ordinary Child Relief. So its probably best if you contact LHDN directly. US-Based Renewable Energy Firm Sets Expansion Goal On Singapore And Malaysia.

Is It Time To Invest Now. Massachusetts has so much money and nothing to spend it on.

America S Best Tax Accounting Firms 2022

到底几时要报税 2017年 Income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

Tax Relief 2020 Wtf Why Changed

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Income Tax Reliefs Rebates For Individual Year 2019

Last Minute Tax Reliefs Have You Maximised Your Returns For 2021

Did You Know You Can Claim Up To Rm37 850 In Tax Reliefs The Simple Sum Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Economic Recovery Plan Rm5 000 Tax Break For Laptops And Devices For Wfh Soyacincau

Special Income Tax Relief For Lifestyle Expenses To Be Extended To December 2022

Malaysia Budget 2021 Highlights Mypf My

Claim Tax Relief For Your Job Expenses 12 Expenses Not To Be Missed Uk Freshbooks Blog

Foreign Businesses Hope China Tax Relief Will Curb Expected Expat Exodus

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Economic Recovery Plan Rm5 000 Tax Break For Laptops And Devices For Wfh Soyacincau

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Internet Subscription Tax Relief Malaysia Madalynngwf

Personal Tax Relief 2021 L Co Accountants